Lost Profits

Written by: Matt Gross, CPA

Within the context of litigation , economic damages are commonly measured using two approaches: lost profits and diminution (loss) of value. The question is, how do I know which approach applies to my case?

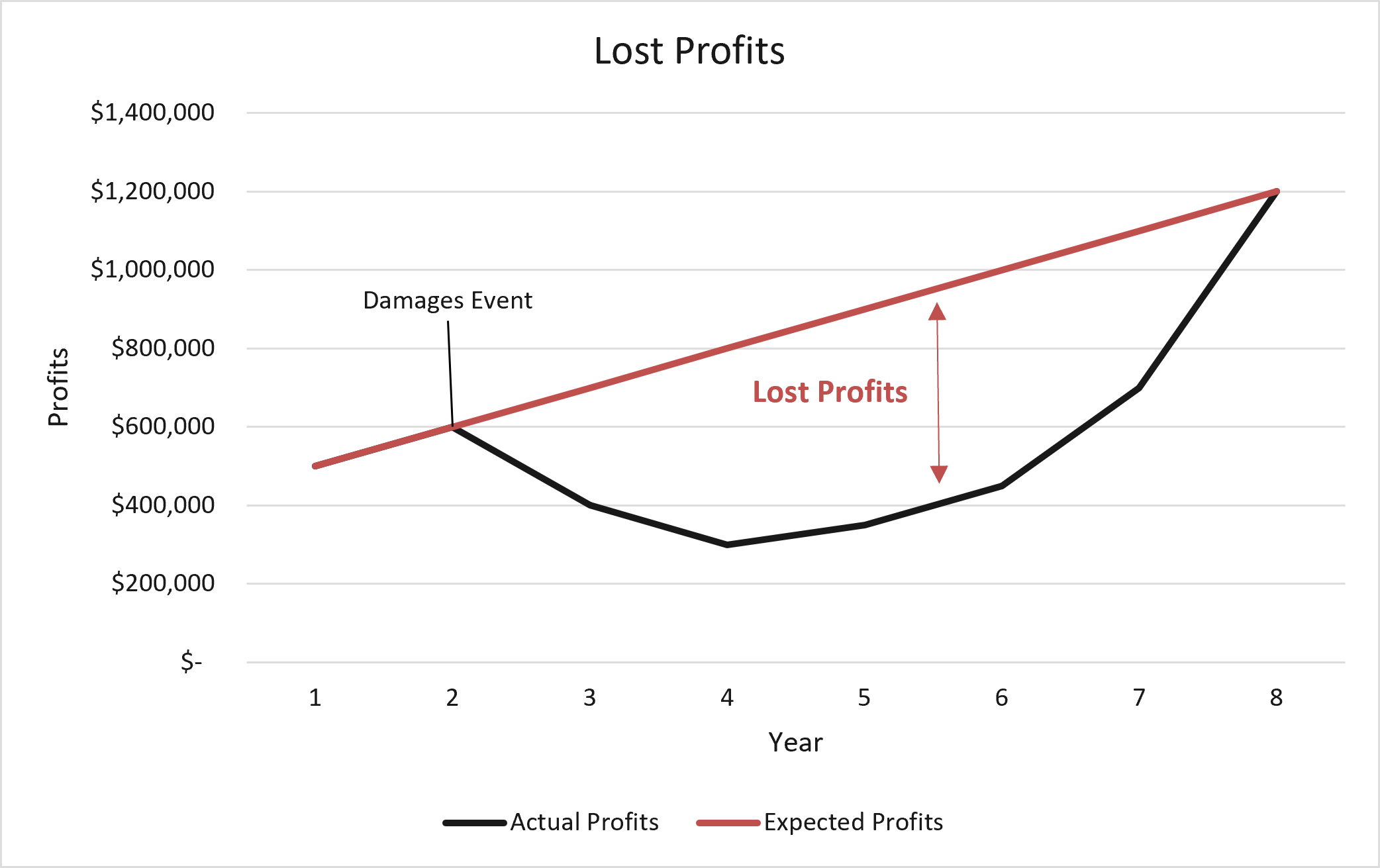

Lost Profits

Lost profits, sometimes referred to as a temporary impairment of a business, occurs when a wrongful act causes a business interruption that results in economic harm (lost revenue, profits, etc.) were it not for the alleged wrongful act of another party. This method assumes that the harm is temporary to the business and that the business will continue to operate into the future, but generally at a lesser profitability. These situations often occur in tort, breach of contract, or trade secrets and intellectual property cases. In order to calculate the damages incurred, one must compare actual profits to what was expected to be earned in profits had the harmful acts not occurred. The difference between the actual and expected profits represents the damages the business has incurred.

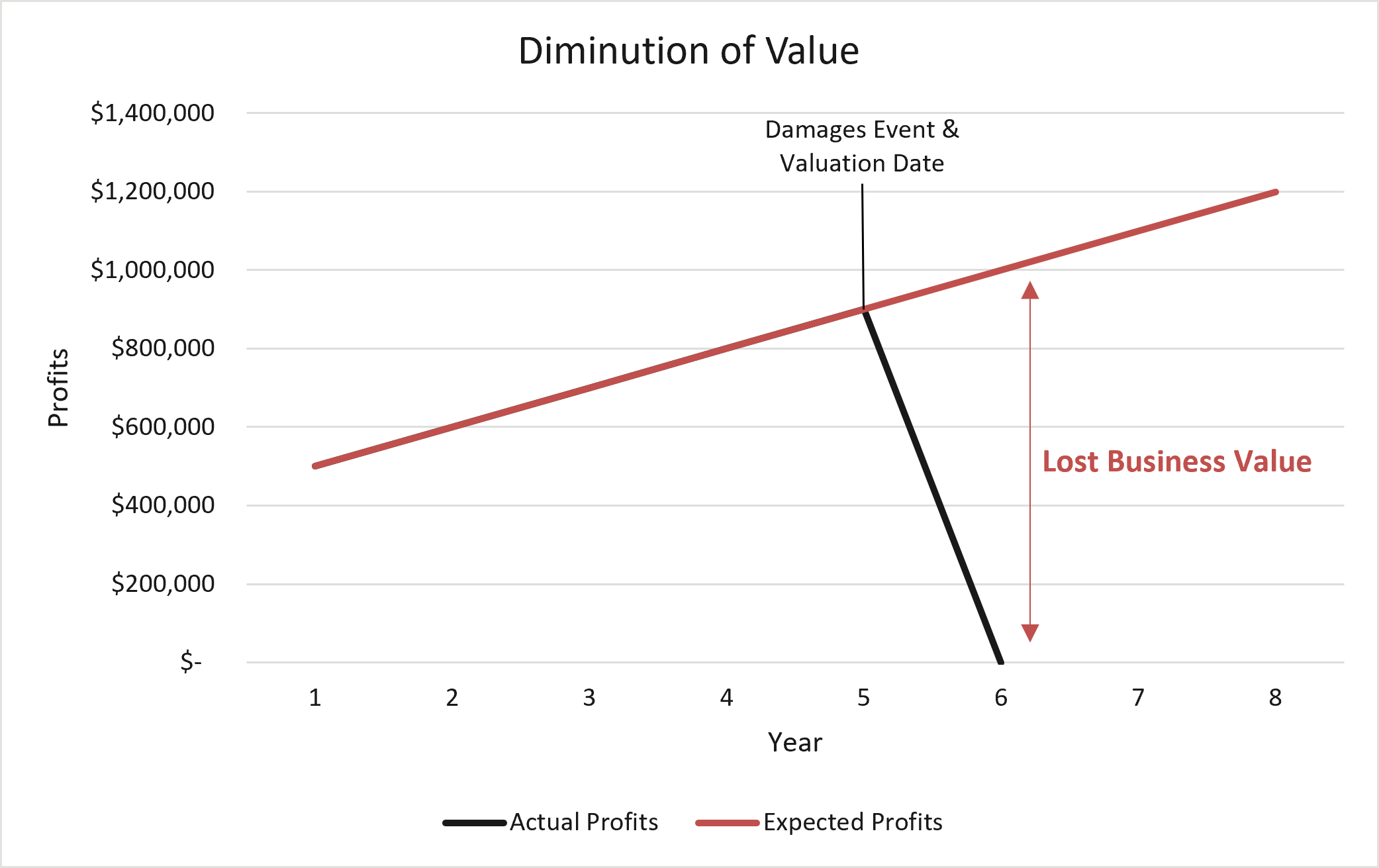

On the other hand, if your business is unable to continue its operations because of the alleged wrongful acts, how can you compare expected profits without any actual profits? The answer lies in the diminution of value approach.

Diminution of Value

Diminution of value, otherwise known as the destruction of a business, occurs when the damages suffered are so severe that the business can no longer continue to operate soon after the damages event.

To quantify the damages, an expert will perform a valuation of the business as of the date prior to the damaging act. The value of the business prior to the alleged wrongful act, compared to the value after, is now the measure of total damages.

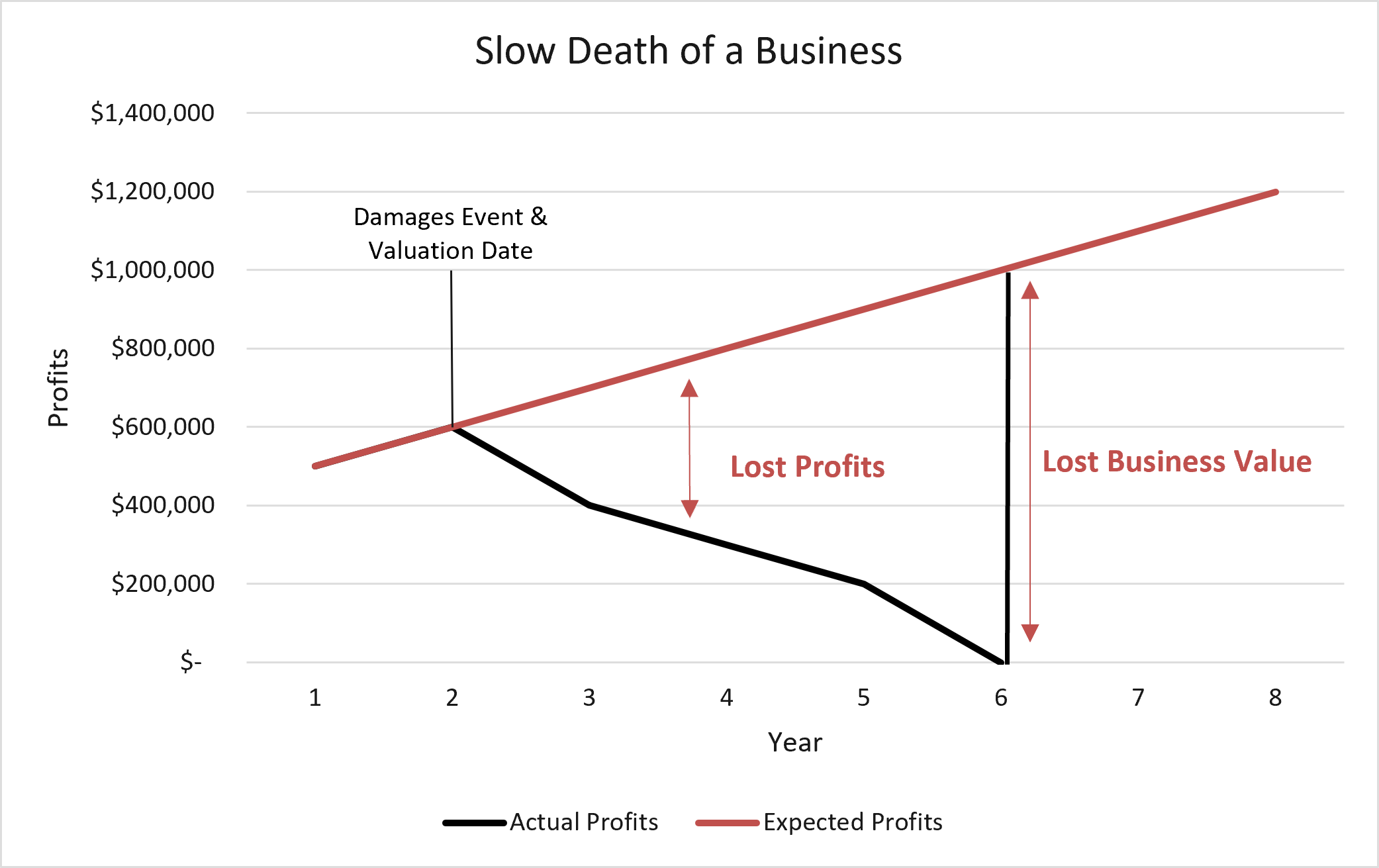

Slow Death of a Business

Lastly, there is a third scenario in which an expert can utilize both lost profits and diminution of value to estimate the damages incurred. This method is referred to as a slow death of a business. This happens when a business suffers harm, continues to operate for a period of time, but ultimately ceases operations as a result of the harm suffered.

This approach attempts to recognize the damage done to the profits stream as well as measure the business’s value at the date the business ceases to operate.

Whether to pursue a lost profits or lost business value claim is an important decision. Under either method, it is important to understand the severity of the impact on your business and how it is quantified. The financial expert must have a credible basis for applying their chosen methodology in order to provide the trier of fact with a reasonable (not speculative) damages calculation. Take the time to find a qualified financial damages expert who has expertise in both computing lost profits and valuing businesses. Although we hope your client doesn’t experience a major financial loss, if the need arises, our 30+ years of experience help us deliver a supportable and unbiased estimate of damages to assist you in resolving the dispute.